TrustHome Properties Inc. now incorporating R. Russell Properties Inc. For more info click here

Reliable Property Management In Orlando

#1 Rated Property Management in Orlando servicing Central Florida

– Residential management for single-family homes and condos.

– Specialists in duplexes and small multi family

– Matching high-quality residents with high-quality homes.

Property Management Services

We generate wealth for landlords by providing 24/7 services to residents and maintain our managed properties occupied with qualified residents. Click here to find out how.

Real Estate Investments

Interested in Real Estate Investment? Click here for your free 30 minute consultation.

Realtor Referrals and Partnership

We love creating relationships with realtors and helping them retain their clients. Click here to find out how.

Local Management for Global Investors: We Protect Your Property

Our combined property management experience spans more than 75 years in Orlando, Lake Nona, Winter Garden, and surrounding communities. We work with out-of-state investors who have specific goals: to earn more and spend less on their investments. We facilitate those results through efficient, automated, and service-oriented property management.

Full-service property management means handling every part of the leasing and maintenance process. We’ll find and place outstanding residents, collect rent on-time, keep residents accountable to the lease agreement, and take care of all routine and emergency maintenance issues.

Leave the details to our team, and enjoy a stress-free, high-profit investment experience.

We stand by our service, and offer 7 owner guarantees.

Our Guide To Property Management In Orlando

Click the button below for a free download of our eBook, which explains the Orlando rental market and helps investors from out of town plan for the properties they will ultimately purchase, and prepare for short term gains and long term success.

Explore the complex world of Orlando Property Management with our FREE eBook

- Understand what it takes to find the right investment property.

- Learn what to look for in an Orlando property management company.

- Discover the value a property manager can bring.

For Renters

Current Residents

Make rental payments, and or submit a maintenance requests through the resident portal. Current residents will find that working with TrustHome Properties is seamless, smooth, and stress-free.

Future Residents

Browse our available properties, review our rental criteria, and or complete an application form. If you are looking for a rental properties, TrustHome Properties has you covered.

Real Estate

We’ll Help You Buy or Sell Properties in areas like Greater Orlando, Medical City/Lake Nona, and UCF.

We believe in full-service management of your investment, and that includes helping you buy and sell properties. Whether you want a single-family home in a Lake Nona HOA community or a small, four-unit building in downtown Orlando, we can help you identify and acquire the right properties for your portfolio. We’ll take you through the sales process too, when you’re ready to make some moves.

Buy a Home that Earns You More

We know the market in central Florida, and we can help you find a property with high rental value.

Transition from Sales to Management

One of the benefits of working with us is that we handle the whole cycle of sale to management to sale.

Enjoy an Efficient Sales Process

No need to worry about showings, staging, pricing, or negotiation. We handle it all for you, from start to finish.

Know Your Neighborhood and Residents

Our resources are precise and comprehensive. We’ll help you buy and sell investments based on market-driven data.

I had a previous management company by the name of great Jones and they were anything but great they had my property six weeks and in those six weeks there was very little communication there were no showings no applications and so I decided to change management companies I researched several companies I got a call from TrustHome and I liked that they were straightforward transparent very excited about renting my property upon inspection of my property they couldn’t understand why it hadn’t been rented being that it was such a beautiful property William Rojas and Stephanie Melendez were just awesome awesome in the process of getting my property rented they officially took over on February 3rd and by February 12th I had 2 I applicants and I now have a tenant which I’m very excited about and they have moved in and they are very satisfied with the property my only regret is that I didn’t sign with TrustHome first then I would have had a tenant maybe as far back as January and thanks to their due diligence I am now officially a landlord and I couldn’t be happier with TrustHome and I highly recommend them they just blew my mind with their honesty communication phone calls updates to make sure I was well-informed and how the process was going plus I got a fair market value on the rent so I give TrustHome five stars to thumbs up

How We Help Orlando Real Estate Investors from Out of State

Orlando and the surrounding central Florida rental market is an ideal place to buy and hold an investment property. Smart investors know they’ll benefit from reasonable purchase prices, high rental values, and a strong pool of stable residents. There’s no need to live here to enjoy the benefits of owning property. TrustHome Properties is your local property management solution. We’ll help you make smart investment decisions and then manage your assets expertly and efficiently.

Here are some of the services that investors like you may find useful:

Identifying Orlando Investment Opportunities

We’ll help you find the right rental property based on your investment goals. Count on us to:

-

Understand the local rental values

-

Understand the general resident pool

-

Establish how long it will take your property to rent

-

Negotiate the best terms for your acquisition

Strategic Marketing and Better Leasing

Investors need high-quality residents to have a positive and profitable rental experience. We provide that through aggressive online advertising that reduces vacancy periods, and rigorous resident screening that delivers the best applicant.

Protecting Your Investment Property

Protecting your investment is a responsibility we prioritize. Your peace of mind is paramount, and we provide a stress-free experience thanks to our attention to lease enforcement, timely rent collection, and immediate maintenance response.

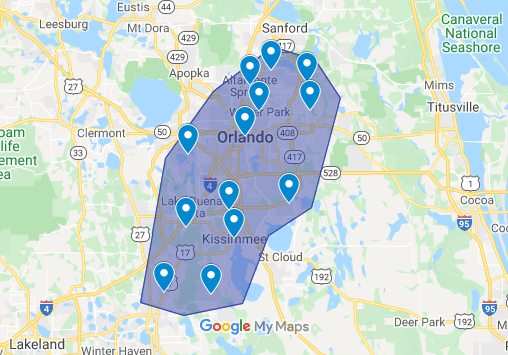

Areas We Serve in Central Florida

We manage real estate all over Central Florida

TrustHome Properties is the undisputed property management leader in Central Florida. We have a keen understanding of the local market, including experience with nuanced neighborhoods like Medical City and the regions surrounding UCF. We bring industry-wide resources and best practices to our local properties, providing investors with the most innovative property management solutions.

Orlando | Celebration | Davenport

Kissimmee | Lake Nona | Oviedo

Poinciana | Altamonte Springs | UCF

Hunters Creek | Windermere | Winter Park

Winter Springs | Casselberry | Waterford Lakes | Avalon Park

Orlando

Celebration

Davenport

Kissimmee

Lake Nona

Oviedo

Poinciana

Altamonte Springs

Avalon Park

Casselberry

UCF

Hunters Creek

Waterford Lakes

Windermere

Winter Park

Winter Springs